The price of pure solid-state LiDAR has dropped to around $100, ushering in new opportunities for car manufacturers to mass produce!

Time:2023-10-16Number of views:3223Recently, Jin Feng, CEO of Pure Solid State Lidar Company Xintan Technology, revealed to Xinzhijia that Xintan Technology's pure solid state Flash blinding lidar has been priced down to around $100.

Like the most intense war, high prices have long been the number one enemy hindering the large-scale installation of LiDAR. Before 2015, the selling price of laser radars sold by foreign manufacturers was as high as $80000, becoming a component that Robotaxi players had to pay for despite biting their teeth.

From $80000 to $100- it's not an exaggeration to say that LiDAR has reached the price milestone of getting on the car. In the past decade, even though the ASP of the forward facing ADAS lidar has dropped from tens of thousands of yuan to thousands of yuan, it is still difficult for car companies pursuing cost reduction to accept mass production of mainstream models below 300000 yuan.

Reduce costs, ensure delivery, improve reliability It has become a key target for various car mounted LiDAR companies at present. And from mechanical to semi solid and now to pure solid, the laser radar technology route has iterated to the 3.0 car era. Compared to the previous two generations, pure solid-state LiDAR has higher integration and no mobile components. After the technology matures, it has the advantages of lower costs, easier to pass vehicle regulations, and higher reliability. Therefore, there are not many domestic and foreign manufacturers investing in this technology route.

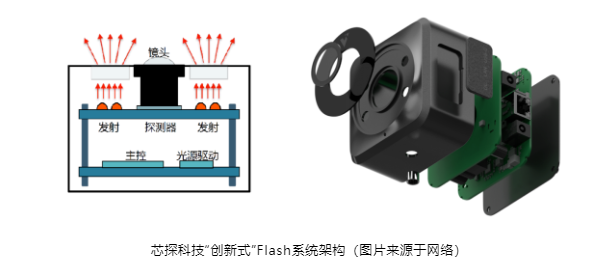

The components of the Flash LiDAR system are not complex, but there are many high barriers to achieving the optimal balance between performance and cost. How did Xintan Technology, which was only established for about a year, lower its price below $100? New Smart Drive has conducted exclusive disassembly of this series of products.

一般而言,一款硬科技产品的总成本结构主要包括 物料成本、制造成本、运维费用。我们先来看看关键的物料BOM成本。作为核心功能是测距的传感器,芯探科技走的是Flash技术路线。

Flash的概念最早从手电筒的闪光式叫法沿袭过来,从原理上来看,Flash 激光雷达通过在短时间直接发射出一大片覆盖探测区域的激光,再以高度灵敏的接收器,来完成对环境周围距离图像的绘制。

相比于机械式激光雷达、半固态激光雷达,纯固态激光雷达没有任何类似MEMS、转镜、棱镜等活动扫描部件,整体架构仅由光源(激光发射模组及驱动)、镜头、探测器、主控器这四大核心部件构成。

1.VCSEL数量较之竞品减半

在发射端,芯探科技和Lumentum深度战略合作,采用车规级多节VCSEL(Vertical-Cavity Surface-Emitting Laser,垂直腔面发射激光器)芯片。

目前业内不少Flash激光雷达玩家都采用VCSEL作为Flash激光雷达的发射光源,这种发射器因在2017年被苹果用在iPhone X Face ID模块中而实现大规模商业化应用,Lumentum、II-VI等是头部供应商。其中Lumentum是苹果iPhone系列手机的VCSEL供应商,并且是业界第一个符合 AEC-Q102 标准的VCSEL供应商。在车载方面,Lumentum也是禾赛等车载激光雷达厂商的供应商,规模化出货使得其VCSEL成本不断下探,售价往往只需小几美金。不同的是,禾赛的FT120、速腾的E1要搭载16颗可寻址VCSEL,而芯探科技M系列Flash激光雷达则只要8颗VCSEL即可达到一样的测距范围(30米)。

在VCSEL价格方面,相比于禾赛、速腾,目前芯探科技的采购量正处于快速爬坡阶段,但据新智驾了解,由于看好芯探科技的产品潜力,Lumentum亦给予了非常大的价格支持。

减半的VCSEL数量、相同的进价——这意味着在发射端的成本,芯探科技Flash激光雷达就降了一半,结合其自研的VCSEL驱动电路,仅用简单的MOS管电路即可高频驱动大电流的VCSEL,这使得在其发射端的成本优势进一步扩大。

2.探测器:车规级ToF芯片

The photodetector is the most core component of Flash LiDAR. This core detection technology adopts the latest generation ToF sensor from its strategic partner ESPROS and innovatively develops it on the detector chip, further significantly improving the chip sensitivity and environmental light suppression ability, and better meeting the application needs of Flash LiDAR.

APD (avalanche diode), SPAD (single photon avalanche diode), and SiPM (silicon photomultiplier tube, composed of multiple SPADs with quenching resistors in parallel) are currently the three main types of lidar detectors.

In the automotive field, various companies are developing from APD to SPAD in order to reduce costs and enhance ranging performance. According to different performance requirements, the price of an APD chip can fluctuate between $10 and $100, with a very wide range. In addition, Jinfeng explained to New Smart Drive that even if the number of APD shipments increases, its price reduction space is limited.

APD is like diamonds, it doesn't mean that because diamonds are sold too much, the cost will decrease, but Swarovski will be cheaper because it is glass, which determines its scale and cost will be very cheap. "Jin Feng said that the detector chip of Core Detection Technology belongs to silicon based semiconductors, and its cost is the cost of mature CIS image sensors, usually only over ten dollars.

Here's to learn about Espros, a supplier of Time of Flight (ToF) sensors established in Switzerland in 2006. Prior to this, Jinfeng was the market and technical director of Espros in China. Among the suppliers developing ToF sensors, foreign manufacturers mainly include Sony, Canon, and Ansemy, while domestic manufacturers include Fushi Technology, Lingming Photonics, and Core Vision.

Espros has a deep technological accumulation in semiconductor technology and Pixel pixels, and launched the first 8 as early as 2012 × The 8-pixel ToF sensor chip, while domestic manufacturers have only been continuously launching stable mass-produced similar products in recent years. Foreign manufacturer Ansemy has been developing car mounted ToF chips for many years, but they still cannot be commercialized for mass production

At present, Espros's detector chips are relatively mature, so from the start of research and development in November 2021, product finalization in June 2022, production in October 2022, and mass production and delivery in December 2022, Core Probe's products can be delivered in one year, and no Flash LiDAR manufacturer can achieve this speed, "said Jin Feng.

3. Main control chip: The only LiDAR in the industry that uses MCU as the main control

If the detector is the "eye" used by LiDAR to sense distance, the main controller is equivalent to the brain, and its core function is to calculate distance and process algorithms. Unlike the FPGA chips chosen by other Flash LiDAR manufacturers, the main control chip of Xintan Technology is a car grade MCU. As a customized ASIC, MCU and FPGA are completely different devices, and the development process and ideas are also different. FPGA is a software algorithm implemented in hardware, essentially a large-scale parallel computing device that can efficiently perform parallel and floating-point operations, but the price is also relatively high, and the price of car grade FPGA is even more expensive. ASIC is a specialized customized integrated circuit that can optimize algorithms for specific functions during the development phase.

During the operation of LiDAR, it continuously emits laser light and collects information about the reflection point. At the same time, it records the time and intensity of the occurrence of the point, and then calculates the distance of all reflection points. The sum of the distances of all reflection points forms a point cloud. How to handle a large amount of point cloud data is the key to making good use of LiDAR, which involves multiple floating-point operations, trigonometric function operations, and a large amount of coordinate system conversion operations, which has a great demand for computing resources. However, in Jinfeng's view, choosing FPGA as the main control chip in the industry today would result in higher costs. However, if the distance calculation algorithm of LiDAR could be optimized based on the most basic ToF principle, it would actually eliminate the need for so many computing resources for parallel and floating-point calculations.

Xintan Technology has optimized the distance calculation algorithm of LiDAR in principle, so that a cheap MCU can meet the distance calculation and algorithm resources of the entire LiDAR. As a result, the cost of Xintan Technology LiDAR in terms of main control chips has further decreased, only one-sixth of that of its peers.

4. Optical lenses: In terms of optical components, the domestic camera supply chain is quite mature, so the cost difference among manufacturers in this area is not significant at present.

In addition to packaging consumables, fasteners and other materials, the final large-scale selling price of the Core Detection Technology Flash LiDAR can be achieved at around $100. According to Xinzhijia, the average price of pure solid-state Flash LiDAR from domestic manufacturers is around $200, while that from foreign manufacturers is around $300.

Over time, when will ToF technology and even LiDAR achieve large-scale commercialization?

In Jinfeng's view, the first step is to make the price of LiDAR plummet while meeting the performance requirements to open up more applications. The second step is to make LiDAR easier and better to use. A good LiDAR needs to be used in a car. The first requirement is high reliability, and it should not cause problems when encountering interference environments such as vibration, high and low temperatures. The second requirement is that the product's angular resolution, measurement distance, volume, price, and other indicators should be balanced, and the third requirement is ease of use. The term 'easy to use' here refers to making it easy for customers to use, preferably just like a camera, plug and play. On the other hand, it refers to optimizing the software of the LiDAR itself to quickly adapt to the entire software system of the car, allowing customers to use it foolishly. For LiDAR manufacturers, the ease of use of the product will be a core point in the future.

To some extent, LiDAR can be likened to a camera. Today's LiDAR, like previous card machines, still needs to adjust parameters based on indoor or outdoor scenes. However, the current camera has been iterated until it can be taken. To achieve this level, LiDAR needs to be further upgraded at the software algorithm level.

However, whether it is improving reliability, anti-interference ability, optimizing algorithm compatibility, improving target detection accuracy, etc., these all need to be gradually improved after the product is polished in the complex real environment on the vehicle.

The important step in getting on the car is to pass the car regulations, where the components need to pass the AEC-Q series universal testing standards, and the entire LiDAR machine also needs to pass third-party car regulations certification. This is a quite time-consuming and labor-intensive process. "There are two problems when communicating with customers after all the product specifications have been passed. One is that the time cycle can be very long, and the other is that it is easy to 'build cars behind closed doors'. Therefore, now Xintan Technology first ensures that the product's performance and functions meet customer requirements before sending samples to customers, while also allowing the product to pass the specifications, rectify, and optimize," Jin Feng said.

In addition to passenger cars, commercial vehicles, unmanned delivery vehicles, and service robots are also the application scenarios for LiDAR.

In terms of commercial vehicles, Xintan Technology is currently in deep cooperation with a certain commercial vehicle manufacturer and plans to install two blinding lidars on the rearview mirrors of its commercial trucks for BSD detection. At the same time, in terms of autonomous driving, it is also being customized and developed with the largest L4 Robotaxi automobile manufacturer in China to meet the 360 ° visual obstacle avoidance requirements of autonomous vehicles. When selecting a LiDAR, the focus of commercial vehicles and RoboTaxi is not the same. The former values the reliability of the product itself, while the latter values the cost factor more.

The war of Flash LiDAR in passenger car blind scene has not really started yet, and the forward scene has already killed the Red Sea. Jinfeng believes that it is better to let the product land in other just needed scenes such as commercial vehicles first, which can not only generate revenue, but also synchronously improve product reliability and optimize algorithm compatibility, When the competition for future in vehicle blinding lidars begins, Xintan Technology can quickly enter passenger cars.

In both the automotive and non automotive fields, Xintan Technology is positioned as Tier 2, for example, Xintan Technology's Flash blinding lidar can be integrated into the car lights before boarding.

The industries where LiDAR can be applied and implemented are actually quite extensive, but truly serving an industry well often requires a lot of resources and effort. It is easy to dive in and cause actions to deform, turning into everything from module factories to integrators, creating enemies on all sides and hitting walls everywhere.

Each industry has its own barriers and demands, and without deep penetration, industry problems cannot be solved. For example, in the scenario of using LiDAR for unmanned forklifts, it is easy to become a forklift manufacturing company instead of a LiDAR company

Jinfeng stated that as a third-generation LiDAR company, the core role of XinTan Technology's products is distance measurement. The value of XinTan Technology is to enable LiDAR to achieve true large-scale application through solution providers and industry end customers.

The automotive field is slightly different. LiDAR is facing a more complex and uncontrollable open road, which requires LiDAR manufacturers to have stronger system processing capabilities, integration capabilities, and complex scene resolution capabilities. Therefore, in the automotive market, whether it is the core technology link or in the early stage of communication with car manufacturers, Core Exploration Technology, together with solution providers or Tier 1 manufacturers, participates in the communication with end customers.

The key is to achieve benefit sharing upstream and downstream of the industry chain, "said the industry veteran who has been involved in ToF technology for more than ten years.

Article source: New Intelligent Driving